|

Market

Update

January 19, 2016 | Telephone: 415.209.9463 |

|

|

|

Current Trends

Recently, there have been great articles in the Wall Street Journal around economic forecasting (Three Economists Walk Into a Bar and The End of Economic Forecasting) that put into perspective the complicated nature of predicting complex systems, such as the global economy or our own industry: wine. On such a large scale, direction can be altered by very small changes that are not predictable. In fact, the first article linked above states that between 2008 and 2009, not a single of the 62 recessions around the world were predicted until after they had started to happen. Predictions can be useful with a shorter time-horizon, but need to come with probabilities and assumptions.

We analyze the wine industry supply and demand by variety and region because it is not only more valuable to look at, but a more accurate projection due to its micro-economic nature. For each client, they may weigh the variables affecting the market differently and best buying or selling decisions may differ from another with the same variety from the same region. Simply put, making big picture one size fits all trend analysis is risky. With so many nuances to our industry, we continually say, “Just because you may know price does not mean you know the market.”

Our market update to start the 2017 year is very similar to what we wrote in December, but new metrics have surfaced as we enter the new year.

|

|

|

According to BW166, consumer sales and shipments of domestic still wines are predicted to have grown about 3.5% in 2016, and dollars are predicted to have grown a percentage point or two higher. Direct to consumer shipments also continue to grow as well, up 18% over the last 12 months according to Wines and Vines Analytics, and is an ever increasingly important sales channel amid the consolidation of distributors.

Just like last year at this time, Turrentine brokers are already actively negotiating deals on bulk wines and grapes. In the vineyards, planting has slowed considerably from the robust pace of 2011 through 2013 in the interior, but the conversations around planting in the North Coast have increased. A larger percentage of the total supply of grapes are already under contract for 2017. So far, 2017 grape demand is consistent with what we saw one year ago for most varieties.

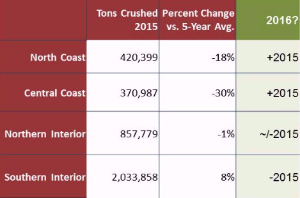

The 2016 harvest could be similar in overall size, but entirely different due to a return to more normal yields on the coast and lighter yields in the Southern San Joaquin Valley.

|

|

|

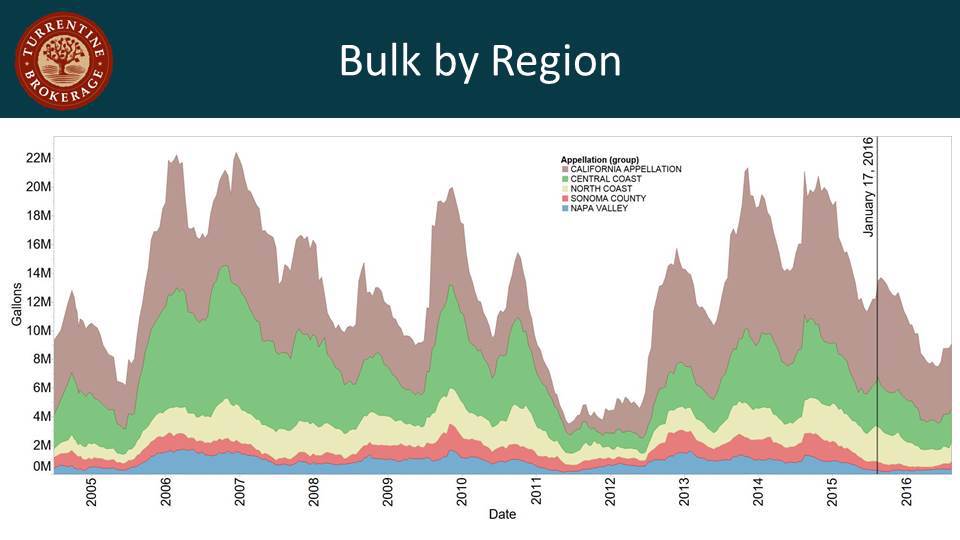

Due to the larger 2016 crop in coastal regions, there will be increased bulk gallons available of 2016 coastal wine than we saw from the 2015 crop.

Demand for quality bulk wine and grapes to establish or grow brands at $10.00 per bottle and above is still strong and driving the grape and bulk market; however, buyers’ quality standards for grapes and bulk wine continue to increase. Buyers of grapes and bulk wine in coastal regions are more concerned with the increased prices of grapes and bulk wine than last year, especially when it is challenging to raise the bottle price of established brands and challenging to get access to the constricting distribution network. In fact, some clients have either flexed appellation from a Coastal base to a Lodi-Clarksburg base or have just backed out of the market altogether. On the not-so-positive side, demand for value priced bulk wine for entry level wines or extending and lowering the price of blends continues to be soft.

For more bulk market information, please see our December Newsletter.

|

|

|

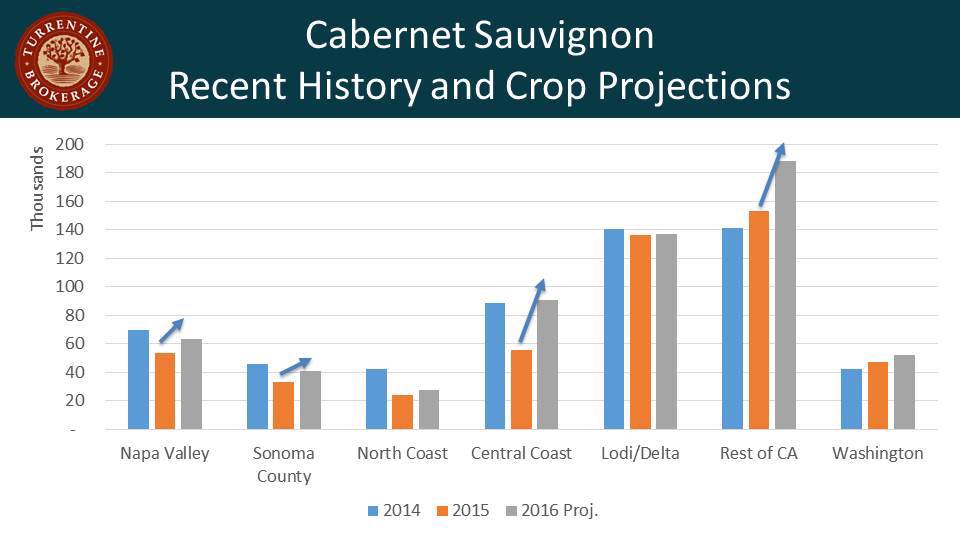

Cabernet Sauvignon

The 2016 harvest, in general, appears to be close to early-season projected yields in most areas of the state. This represents some fairly sizeable increases in coastal regions over a lighter 2015 crop, especially in the Central Coast, Napa Valley and Sonoma County. The increased tons from the Central Coast alone could be around 35,000 tons, which loosely translates to 5.8 million gallons of wine.

The increased supply is beginning to become available to the bulk market. We expect to see an increase in 2016 North Coast Cabernet Sauvignon in the near future, but Napa Valley and Sonoma County are expected to remain tight for some time yet. Demand remains strong for 2015 Sonoma County and any 2016 that becomes available. Demand for Napa Valley is also strong, but increased quality standards and price sensitivity has slowed the market. Sellers are typically asking for $50.00 or more per gallon and buyers are between $35.00 and $45.00 per gallon. In the interior, we are already seeing 2016 wines make their way to the market, and bulk supplies are still limited from a historical perspective. Buyers are interested in Paso Robles Cabernet Sauvignon, but are balking at the high asking prices.

On the 2017 grape market, there are very few uncontracted and available tons for sale because of strong demand throughout the state. Despite a larger harvest in many areas of the state, activity is similar to this time last year, and buyers are working fervently on sales projections before committing to the grape market but are sending us their wish lists before available supply dries up. Specifically in Paso Robles, the best vineyards at the right price are currently being pursued, and there are more tons currently available than any point over the last three years. Despite the activity, there are concerns from both buyers and sellers on pricing. Buyers are concerned about the inability to raise bottle price, and sellers are concerned about the increased costs of production.

|

|

|

Chardonnay

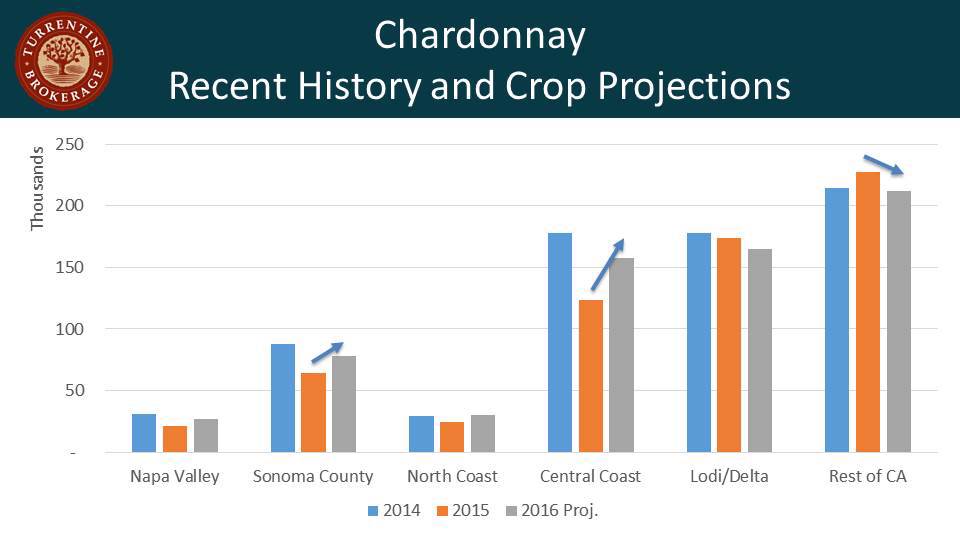

In 2016, there was greater variation in yields per acre for Chardonnay statewide than for Cabernet Sauvignon. 2016 yields per acre were greater in Sonoma County, but will likely fall short of 2013 and 2014. Throughout the rest of the North Coast, grape yields per acre returned to average. Due to a poor set and mildew pressure, yields per acre from Monterey County will be down again from the 5-year average, but overall, not to the extent of 2015. In the San Joaquin Valley, the crop may be 5% below expectation on a relatively stable acreage base.

Half of the bulk gallons actively for sale are 2016 vintage from the Central Coast and California Appellation, but the majority of recent sales are from Napa Valley and Sonoma County where supply is still very tight. To an extent, there has been some activity for Sonoma Chardonnay, but as buyers are seeing more options, wines are staying on the market longer. Programs are generally trying to figure out what inventories they have on-hand and what they are going to be doing throughout the 2017 calendar year. More 2016 vintage gallons will continue to make their way to the market over the next quarter.

Chardonnay demand for 2017 grapes is hot and cold depending on the region, but it is still quite early! Demand for Russian River and the Sonoma Coast are among the hottest regions right now, and there has also been interest in Chardonnay from Lake and Mendocino County. In Monterey and Santa Barbara Counties, there is limited availability with moderately strong demand.

|

|

|

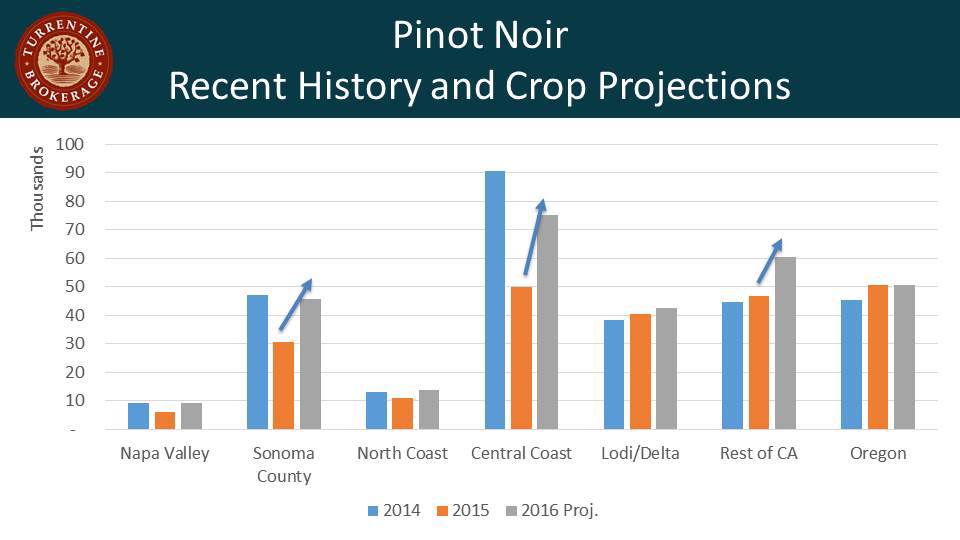

Pinot Noir

The 2016 Pinot Noir harvest was better than 2015, but that isn’t saying much. Throughout the North Coast, yields per acre rebounded to long-term average levels, and interior yields came in about 10% below average. Wineries and growers both wanted more fruit from the 2016 harvest, which stimulated another early market for the few uncontracted 2017 grapes. With retail sales growing at nearly all price points, demand for 2017 Pinot Noir grapes is quite strong early in the year throughout the state. Buyers are picking up the pace on resigns and looking for additional supply in the interior, Monterey, Santa Barbara, Sonoma County and the North Coast.

The bulk market hasn’t been as active, however, there appears to be a stand-off at this point in price between buyers and sellers for Sonoma County Pinot Noir. There have been some deals for Central Coast and California Appellation Pinot Noir, but the market hasn’t gained momentum yet to this point.

|

|

|

Red Blends

Many wineries were able to get more of their supply of red wines to grow proprietary red blends and to improve and darken blends to compete above $9.00 per bottle through the grape market in 2016 due to the increase in new bearing acres in Lodi and the Central Coast. Bulk sellers have indicated larger amounts of Petite Sirah and Petit Verdot wine that will likely come to the market, but demand has moderated from last year. There has been some bulk demand for Napa Valley Merlot and Lodi Zinfandel, but the broad bulk market for both varieties is still relatively slow. |

|

|

Washington & Oregon

The 2016 Washington harvest was a record crop, with 292,000 tons crushed. With increased acreage being planted, along with above average yields there continues to be an opportunity for buyers. Cabernet Sauvignon continues to be the variety with the most opportunity on the bulk market today, with spot pricing on 2016 vintage in the $10.00 to $14.00 per gallon range.

2016 Oregon vintage was down from their record breaking 2015 vintage; however, opportunities for both 2015 and 2016 Pinot Noir still remain. Increased plantings in southern Oregon have created new opportunities for buyers for both spot wines and future production contracts for Pinot Noir and Pinot Grigio. There continues to be a large price spread between the Willamette Valley and Southern Oregon. We have seen pricing range from $12.00 to $18.00 per gallon on Pinot Noir.

|

|

|

Global

Overall global wine quality continues to improve, just like in the U.S., with a greater percentage of wine being made to meet consumer preferences with higher color and sweetness and lower tannins. There is plenty of wine available to compete in the market for $10.00 plus wines.

The market in Europe is similar to last year. There were ups and downs in 2016 yields across the regions. In France, there were well-documented short crops in Burgundy and Loire, but reasonable crops in the Languedoc, Rhone, Bordeaux, and Provence. Spain and Italy fared better with good yields and good quality in most regions.

|

|

|

|

|

In the Southern Hemisphere, the 2017 harvest is beginning to take shape. The total Australian crop will be tough to predict because of a spotty but severe hail event earlier in the season in the irrigated regions. The most important dynamics are that grape demand and prices are higher than last year, bulk demand is steady and reasonably strong, and bulk supply actively for sale is down—especially for red wines.

In Argentina, the bulk market supply is short due to last year’s very short crop, and entry level wine producers are searching for bulk wine in Chile to make up for what they don’t have. Asking prices are high for what bulk wines are available. The 2017 crop could still be short of demand.

In Chile, the market could be described as fairly stable. Bulk prices remain steady and demand from global buyers is strong. Prices for 2017 grapes are higher than last year and match pretty well with the current prices for bulk wine.

An attention-grabbing headline a few weeks ago warned of a shortage of bulk wine. Do not fear—there is plenty of wine! Buyers will just have to plan ahead, and possibly be prepared to pay a higher price, accept lower quality, or look to regions they aren’t as used to. In the past when global supplies are lower than average, we have seen bulk wine imported from many regions including the Republic of Georgia, Bulgaria, and Hungary for example. We have recently received offers of supply from the Ukraine. What is important to remember is that the global production of wines to compete in the U.S. at $10.00 and above has increased, so the market could remain very competitive for wineries to grow sales in that price point.

We would love the opportunity to talk with you more specifically about your individual situation, so please stop by our Booth #1311 at Unified.

|

|

|

2017 UNIFIED SYMPOSIUM - Booth # 1311

January 24th-26th

The entire broker team will be at Unified and we look forward to seeing everyone. Contact your broker to set up a meeting, or just stop by the Turrentine booth located on the first floor, exhibit halls A-E. Click here for more information. |

|

|

LODI GRAPE DAY

February 7th

Grape Broker Erica Moyer makes this a regular event on her calendar to attend.

Click here for more information.

CLARKSBURG GRAPE DAY

March 1st

Come listen to Erica presenting at this event, located at the Old Sugar Mill Gallery. We will also have a booth to visit..

Click here for more information.

|

|

|

|

|

WASHINGTON ASSOCIATION OF WINE GRAPE GROWERS CONFERENCE

February 7th

Steve Fredricks will be speaking during the State of the Industry session. Bulk wine Broker Neil Koch will also be in attendance. Click here for more information. |

|

|

CENTRAL COAST INSIGHTS

March 14th

Grape Broker Audra Cooper and Bulk wine broker William Goebel will be speaking at this event, as they cover the Central Coast grape and bulk wine markets.

Click here for more information. |

|

|

WiVi CENTRAL COAST

March 15th

Stop by the Turrentine booth at the largest gathering of wineries, growers and vendors

on the Central Coast. Click here for more information. |

|

|

| |

|

AVAILABLE

+2015/2016 Paso Robles Cabernet Sauvignon

+2015 Central Coast Pinot Noir: 16 lots

+2015 Central Coast Chardonnay: 15 lots

+2014/2015 CA/Lodi Zinfandel: 33 lots

+2014/2015 Sonoma County Zinfandel: 18 lots

+2014/2015 Central Coast Merlot: 33 lots

+2016 CA & North Coast Sauvignon Blanc

+2016 CA Pinot Grigio

+2015/2016 CA Pinot Noir: 160,000 gal.

+2015/2016 Blush Wines: 21 lots

+2014/2015 WA & OR Red and White Wines

+2016 WA Cabernet Sauvignon

+2016 OR Pinot Noir

+2016 Sonoma County Pinot Noir

+2016 Sonoma Coast Pinot Noir |

|

|

NEEDED

-2015/2016 Napa Valley & Sonoma County Cabernet Sauvignon

-2015 Napa Valley & Sonoma County Red Bordeaux Blenders

-2016 Sonoma County Chardonnay & Pinot Noir

-2016 Monterey County Chardonnay & Pinot Noir |

|

|

BULK WINE BROKERS

Steve Fredricks, President

415.847.0603

___

Steve Robertson, Broker/Partner

All California & Interstate Regions

415.827.0110

___

Marc Cuneo, Broker/Partner

North Coast, Interior & International

707.217.1369

___

William Goebel, Broker

Central Coast & North Coast

415.798.5515

___

Neil Koch, Broker

North Coast & Interior

415.686.6669

___

Bryan Foster

National Sales Mgr of

Strategic Brands

707.849.9948 |

|

|

GRAPE BROKERS

Brian Clements, Vice President

707.495.8151

___

Erica Moyer, Broker/Partner

Interior & Monterey County

209.988.7334

___

Audra Cooper, Broker/Partner

Central Coast

805.400.9930

___

Mike Needham, Broker

North Coast

707.849.4337

|

|

|

|

|

|

| | | | | |

|  |

|

|

|

|